The term “Trump tariff” refers to the tariffs imposed by the 45th President of the United States, Donald J. Trump, between 2018 and 2020. These tariffs targeted goods from various countries, particularly China, and were a landmark policy of Trump’s “America First” agenda. This article explores the key aspects of these tariffs, their economic impact, and the ongoing debates surrounding them.

What Are Tariffs?

Before we get into the specifics of the Trump tariffs, it’s essential to understand what tariffs are. A tariff is a tax placed on imported goods. Governments use tariffs to:

- Protect domestic industries by making foreign goods more expensive.

- Generate revenue for the state.

- Encourage consumers to buy locally made products.

While tariffs can help local industries grow, they might also lead to tension in international trade and increased costs for consumers.

A Closer Look at the Trump Tariffs

Timeline and Key Industries Affected

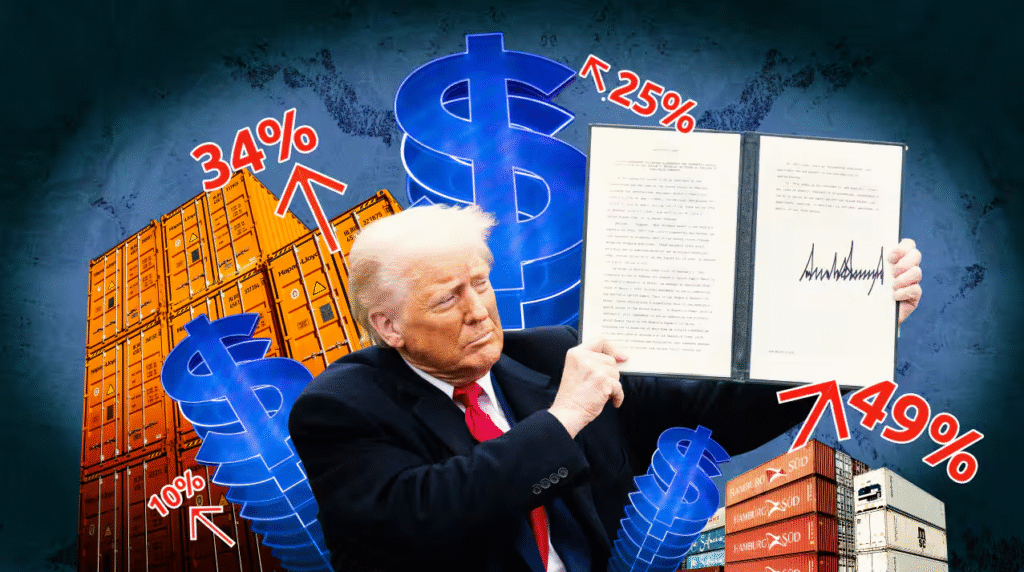

President Trump began implementing tariffs in 2018 as part of an effort to address what he called unfair trading practices and economic imbalances. Here are some of the key dates and sectors affected:

|

Date |

Action |

Affected Products |

|---|---|---|

|

March 2018 |

Tariffs on steel and aluminum imposed |

Steel (25%) and aluminum (10%) |

|

June 2018 |

Retaliatory tariffs from the EU and Canada |

U.S. agricultural products, bourbon whiskey |

|

July 2018 |

First wave of tariffs on Chinese goods |

Tech products, machinery, and autos |

|

September 2018 |

Expanded tariffs on Chinese imports |

$200 billion worth of consumer goods |

|

December 2019 |

“Phase One” trade deal signed with China |

Partial tariff rollbacks |

Spotlight on the U.S.-China Trade War

China was the primary target of the Trump administration’s tariffs. The tariffs on Chinese goods aimed to address:

- Intellectual Property (IP) Theft: Accusations that China forced U.S. companies to transfer proprietary technologies.

- Trade Deficit: The large imbalance in trade between the U.S. and China.

- Unfair Subsidies: Claims that Chinese companies benefitted from government subsidies, undercutting U.S. competitors.

The U.S.-China tariffs sparked a rapidly escalating trade war that reshaped global supply chains and international trade dynamics.

Retaliatory Measures

Countries impacted by U.S. tariffs struck back with their own measures, targeting key American exports such as:

- Soybeans and corn (important to U.S. farmers)

- Bourbon whiskey (economically significant in Kentucky)

Positive Impacts of the Trump Tariffs

Supporters argue that the Trump tariffs helped strengthen the U.S. economy in several ways:

1. Boost to Domestic Manufacturing

By making imported goods more expensive, the tariffs incentivized consumers to purchase American-made alternatives. This was particularly noticeable in the steel and aluminum industries.

2. Job Creation

Certain sectors, especially manufacturing, experienced job growth as companies brought production back to the United States.

3. National Security

The tariffs aimed to reduce reliance on foreign suppliers for critical materials, such as steel, which are considered essential for national defense.

Negative Consequences of the Trump Tariffs

While there were some benefits, critics highlight significant downsides:

1. Higher Costs for Consumers

Tariffs often increase prices, as businesses pass the additional costs on to consumers. Everyday goods like electronics, clothing, and food became more expensive.

2. Strain on Farmers

American farmers faced significant challenges due to retaliatory tariffs, particularly from China. Exports of soybeans, pork, and other agricultural goods plummeted, causing financial losses for many in the farming community.

3. Disrupted Supply Chains

Global supply chains were thrown into disarray, with companies scrambling to relocate production or find alternative sources for materials.

4. Short-Term Economic Pain

Economic studies suggest that the tariffs did not achieve the intended reduction in the U.S. trade deficit and, in some cases, caused short-term slowdowns in economic growth.

The Legacy of the Trump Tariffs

The tariffs’ long-term impact remains a topic of debate among economists and policymakers. While some argue that these measures successfully brought unfair trade practices to light, others point out that they created new economic challenges for American businesses and consumers.

“Phase One” Trade Deal

The signing of the “Phase One” trade deal with China in December 2019 offered some temporary relief, with China agreeing to purchase more U.S. goods and services. However, most tariffs remained in place, leaving unresolved tensions.

Effects on Global Trade

The tariffs underscored the interconnected nature of the global economy. Countries sought new trading partners, and businesses diversified supply chains to minimize reliance on the U.S. or China.

Looking Ahead

Although the Trump tariffs had mixed results, the conversation around them highlights critical questions for the future:

- Will tariffs remain a key tool in U.S. trade policy?

- Can the U.S. effectively counter China’s economic practices without damaging its own economy?

- How will businesses and governments adapt to a world where global trade is no longer as seamless as before?

Final Thoughts and Resources

The Trump tariffs mark a significant chapter in U.S. trade history, with far-reaching implications. While some industries benefited, others faced hardships, leading to ongoing political and economic debates.

To learn more about related topics, visit our comprehensive trade analysis section at Turbotechify. With expert insights and up-to-date analysis, we cover everything from technological advancements to economic trends.

By structuring this article with clear sections, bullet points, and a table, it is both reader-friendly and optimized for SEO, ensuring better engagement and visibility.